Owning a luxury yacht is a dream, but optimizing its tax strategy is where true mastery lies. For many yacht owners, taxation becomes one of the most complex aspects of ownership. Between maritime laws, VAT regimes, depreciation schedules, and cross-border rules, a simple oversight can cost millions. The art of tax optimization for luxury yacht charters involves more than just paperwork—it’s about strategic planning, smart jurisdictional choices, and understanding the difference between luxury and liability.

Tax optimization isn’t about evasion; it’s about intelligent alignment. A well-structured yacht ownership and charter operation can turn a significant tax burden into an efficient, compliant, and even profitable enterprise. Whether you own a private charter fleet or a single luxury vessel, learning to leverage available deductions, depreciation, and international structures will save you both money and headaches.

Understanding Luxury Yacht Charter Taxation

Taxation on luxury yacht charters depends on several moving parts: where the yacht is registered, where it operates, and how it’s used. Most countries differentiate between commercial and private use, and this distinction determines eligibility for tax deductions and VAT exemptions.

In many cases, yachts that are operated as commercial charter businesses can claim business expense deductions and depreciation. However, personal use must be meticulously recorded and separated. For example, in the U.S., the IRS requires that over 50% of the yacht’s use must be business-related to qualify for Section 179 or bonus depreciation benefits.

European charters, especially in the Mediterranean, are subject to local VAT rules. Malta, France, and Italy all have specific yacht VAT reduction schemes for charters beginning in their waters. Understanding where the “place of supply” occurs can make the difference between paying 12% or 25% VAT.

The Role of Ownership Structures

Choosing the right ownership structure is perhaps the single most crucial step in optimizing yacht taxation. Most yacht owners create separate legal entities—typically Limited Liability Companies (LLCs), corporations, or trusts—to hold ownership of the yacht.

This separation provides multiple benefits:

-

Liability protection for the owner.

-

Flexibility in taxation, allowing deductions for business expenses.

-

Eligibility for VAT refunds in certain jurisdictions.

For instance, if a yacht is owned by a Maltese company but chartered in EU waters, it may qualify for Malta’s reduced effective VAT rates. Conversely, U.S. owners might prefer Delaware or Florida-based LLCs for favorable state tax treatments.

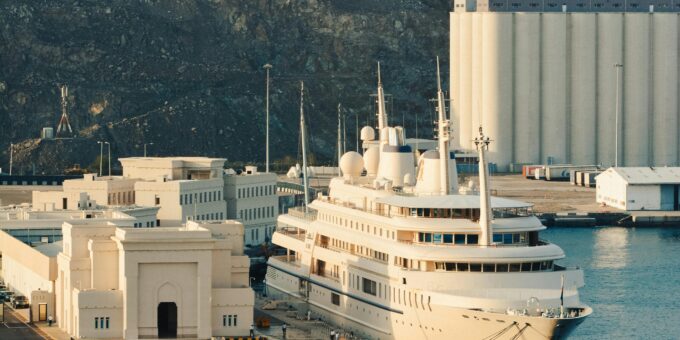

Yacht Registration and Flagging

The flag under which your yacht sails can have a major impact on your tax exposure. Known as “flagging,” this process determines the jurisdiction that governs your yacht’s operations, crew, and taxation.

Common choices include the Cayman Islands, Malta, the Marshall Islands, and the Isle of Man—all of which offer favorable maritime and tax laws.

A well-chosen flag can:

-

Lower VAT or import duty obligations.

-

Provide lenient crewing and operational rules.

-

Simplify cross-border charter operations.

However, improper flagging—especially under “flags of convenience”—may trigger regulatory scrutiny or compliance challenges.

Differentiating Personal and Business Use

To claim yacht-related deductions, it’s essential to clearly separate business activities from personal enjoyment. Charter logs, booking records, and fuel receipts should distinctly show which voyages were commercial.

If the yacht is used primarily for personal leisure, the IRS or local tax authorities may invoke “hobby loss rules,” disallowing most deductions. Therefore, maintaining documentation such as marketing efforts, client contracts, and income statements helps prove genuine commercial intent.

Depreciation Benefits for Yacht Owners

Depreciation allows owners to recover the cost of their yacht over time through tax deductions. In the United States, Section 179 and bonus depreciation provisions have revolutionized yacht ownership for business users.

For example:

-

Section 179 allows for immediate deduction (up to a cap) of qualifying equipment placed into service for business use.

-

Bonus depreciation enables accelerated write-offs, sometimes up to 100% of the purchase price in the first year.

In Europe, yachts used commercially may also qualify for accelerated depreciation depending on local maritime business laws.

Managing VAT for International Charters

Value Added Tax (VAT) is one of the most significant considerations for luxury yacht charters. In the EU, VAT rates vary from 12% to 25%, depending on the country of departure and duration of the voyage.

Malta, for example, has introduced a 12% VAT rate on charters commencing from its ports, while France offers reduced VAT for voyages partially conducted in international waters. Understanding where your charter begins and ends determines the VAT due, and structuring charters through favorable jurisdictions can save substantial amounts.

Offshore Leasing Arrangements

Many owners use leasing structures to spread out VAT payments over time. Under the Maltese leasing model, for instance, a yacht is leased to an operating company, which pays VAT only on a fraction of the yacht’s value, depending on its usage in EU vs non-EU waters.

This setup reduces upfront VAT liability and provides flexibility if the yacht is later sold. However, compliance with EU guidelines and approval from the Maltese VAT Department is essential.

Charter Contracts and APA Management

The Advance Provisioning Allowance (APA) is a critical element of yacht charter contracts. It typically covers expenses such as fuel, food, and docking fees.

Separating APA charges from the main charter fee allows for correct VAT treatment and ensures proper expense deductions. Keep all invoices and receipts, as they serve as proof for tax authorities during audits.

How to Use Section 179 Deduction

For U.S. taxpayers, Section 179 is a golden opportunity. To qualify, your yacht must be used at least 50% for business. The deduction limit may change annually, so working with a CPA is essential.

By combining Section 179 and bonus depreciation, many yacht owners deduct a large portion of their yacht’s cost within the first year—reducing their taxable income significantly.

You Can Also Read : How to Benefit from Tax-Free Zones for Yacht Registration

Expense Allocation for Yacht Charters

Running a yacht involves numerous expenses—fuel, insurance, maintenance, dockage, and crew salaries. Allocating these expenses accurately between business and personal use ensures compliance.

Typically, expenses tied directly to charter operations are fully deductible, while personal-use days reduce deductible percentages proportionally. Always keep detailed records of all expenses to substantiate deductions.