Cryptocurrency mining has revolutionized the financial landscape, becoming the backbone of blockchain technology. If you’ve ever wondered what goes on behind the scenes of Bitcoin, Ethereum, or other digital currencies, mining is the answer. This guide will demystify the process, breaking it into simple, actionable steps for beginners.

Whether you’re tech-savvy or just curious, understanding cryptocurrency mining is the first step toward entering a dynamic and rewarding space. Let’s explore how you can start mining cryptocurrency, even as a novice.

What is Cryptocurrency Mining?

Cryptocurrency mining is the process of verifying and adding transactions to a blockchain network using computational power. Miners solve complex mathematical problems to secure the network, earning rewards in the form of digital currency.

Imagine a decentralized system where no bank is needed—miners maintain this trust by validating transactions. Each block they solve contributes to the ledger’s integrity, ensuring transparency and security.

Types of Cryptocurrency Mining

Mining isn’t a one-size-fits-all activity. There are several methods:

- Proof-of-Work (PoW): The traditional and most popular mining method used by Bitcoin. It requires high computational power.

- Cloud Mining: A hassle-free alternative where users rent mining power from remote data centers.

- Proof-of-Stake (PoS): While technically not “mining,” staking involves validating transactions by holding a cryptocurrency stake.

Each type caters to different budgets, skill levels, and goals.

Understanding Mining Hardware

Your mining hardware determines your success. There are three primary types:

- ASIC (Application-Specific Integrated Circuit): The most powerful and efficient but expensive.

- GPU (Graphics Processing Unit): A popular option for mining altcoins due to versatility.

- CPU (Central Processing Unit): Affordable but less effective for most cryptocurrencies.

For beginners, GPUs strike a balance between affordability and power.

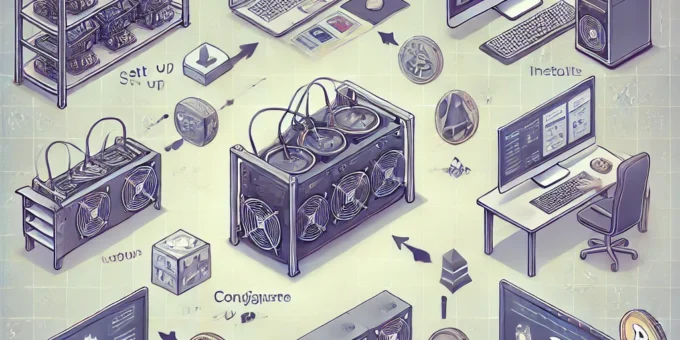

Setting Up Your Mining Rig

To start mining, you’ll need a rig—a system of hardware optimized for mining. Here’s how to set one up:

- Select Hardware: Choose a suitable GPU or ASIC device based on the cryptocurrency you want to mine.

- Install Software: Download mining software compatible with your hardware.

- Optimize Cooling: Overheating reduces efficiency; invest in cooling systems.

- Connect to Power: Use efficient power supplies to minimize costs.

- Link to a Mining Pool: Boost earnings by joining a community of miners sharing resources.

How Mining Software Works

Mining software acts as the bridge between your hardware and the blockchain. Popular options include CGMiner, NiceHash, and PhoenixMiner. They help optimize hardware usage, monitor performance, and connect you to networks or pools.

Always choose software that matches your skill level and mining goals.

The Role of Mining Pools

Mining pools combine resources from multiple miners, increasing the chances of earning rewards. In exchange, profits are distributed among participants. This is ideal for beginners, as solo mining often yields minimal returns.

Look for reputable pools with transparent fee structures, such as F2Pool or Slush Pool.

Electricity Costs and Efficiency

Mining is energy-intensive. Your electricity bill can make or break your profitability. Reduce costs by:

- Using Energy-Efficient Hardware: Choose ASICs designed for low power consumption.

- Mining in Regions with Cheap Power: Some countries offer subsidized electricity rates.

- Switching to Renewable Energy: Solar or wind energy can offset costs.

Profitability Calculators for Mining

Before investing, use profitability calculators like CryptoCompare or WhatToMine. Input your hardware, electricity cost, and chosen cryptocurrency to estimate earnings and determine your break-even point.

Best Cryptocurrencies to Mine in 2024

For profitability and ease, consider:

- Bitcoin (BTC): High value but requires ASICs.

- Ethereum Classic (ETC): Ideal for GPU mining.

- Monero (XMR): Privacy-focused and CPU-friendly.

- Ravencoin (RVN): A promising altcoin for beginners.

Environmental Concerns of Mining

Mining has faced criticism for its carbon footprint. However, trends like green energy mining, hydro-powered facilities, and transitioning to Proof-of-Stake aim to address these concerns.

You Can Also Read : How to Understand Smart Contracts and Their Real-World Applications

Legal and Tax Implications

Cryptocurrency mining isn’t free of regulation. Depending on your country:

- You may need permits for large-scale operations.

- Income from mining is taxable. Keep detailed records to ensure compliance.